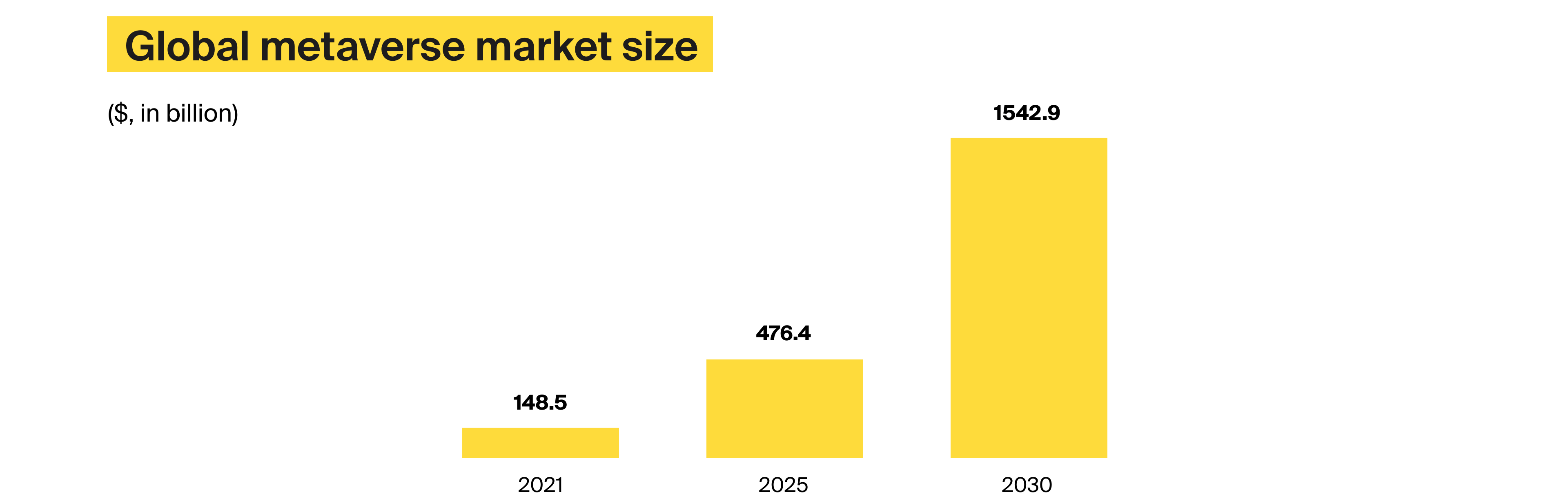

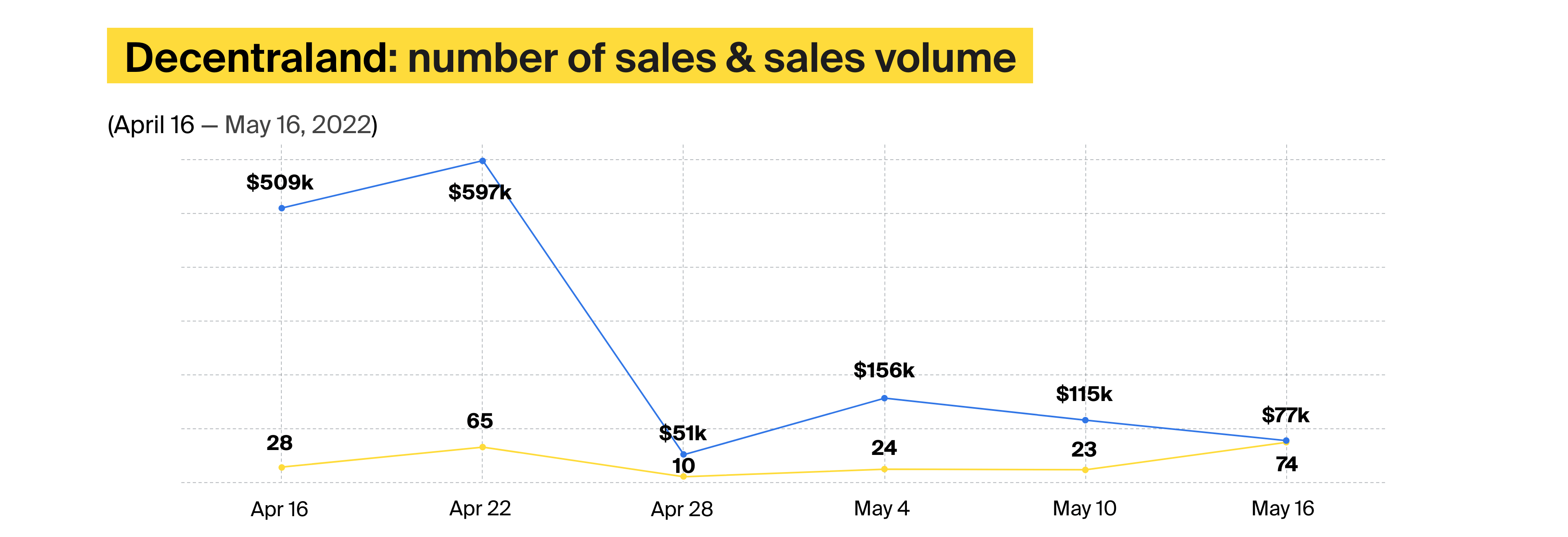

Real estate in the metaverse costs are skyrocketing. Take, for instance, Decentraland. When the platform held its first auction in December 2017, it sold parcels of land for

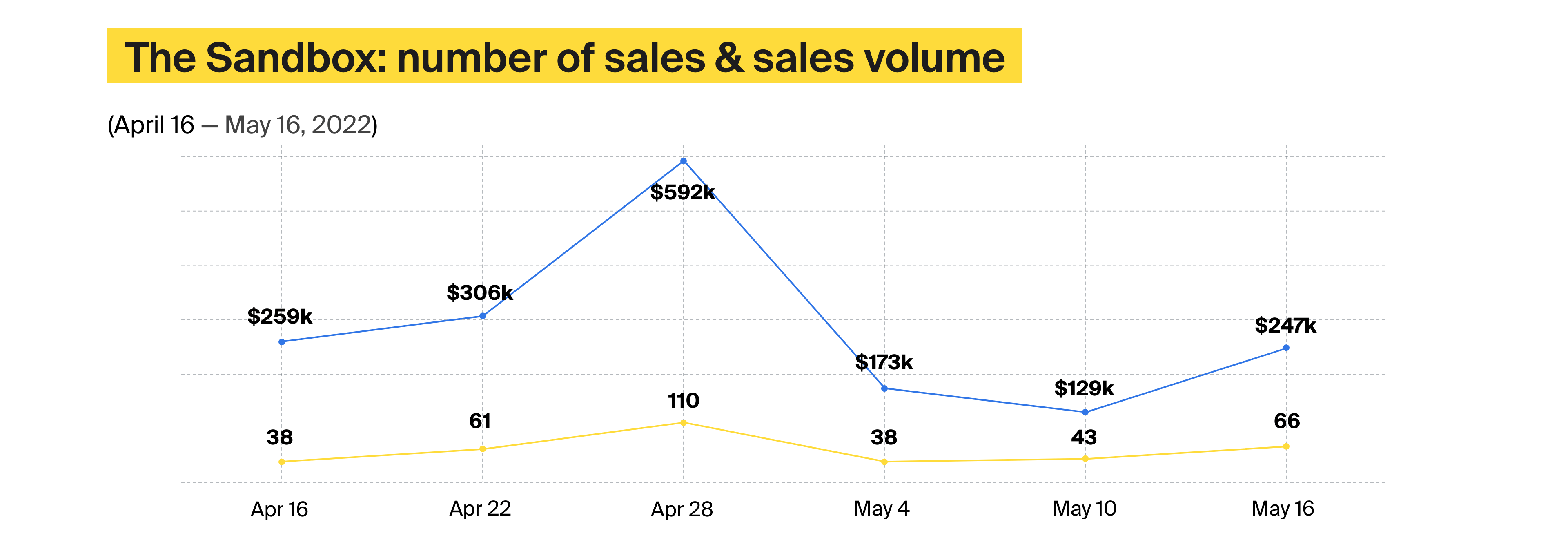

$20 each. By 2021, the cost of this commodity catapulted to $6,000, and it kept increasing to reach $15,000 by the start of 2022. Virtual land on the Sandbox, another metaverse platform, grew by

15,000% in 2021.

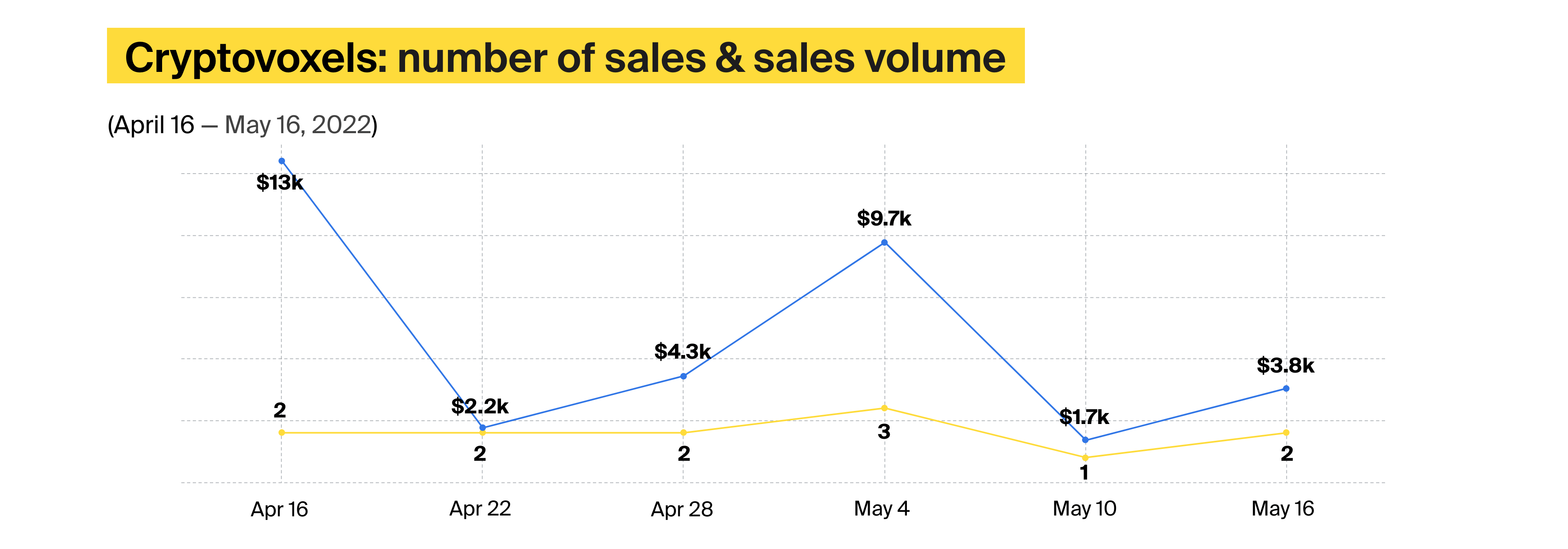

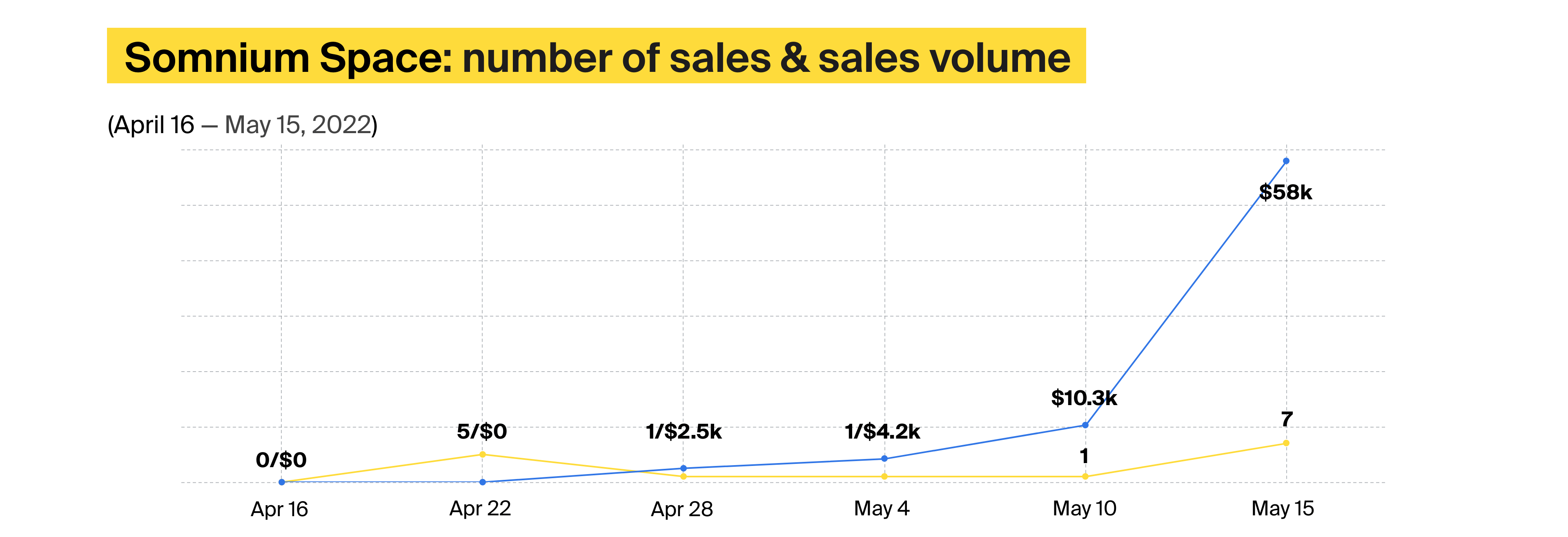

Prices of virtual land plots can vary significantly based on their size, platform, and location. You can get a small parcel in Somnium Space

for $6,362, while a lavish plot on Decentraland would cost you

$2.4 million.

When you prepare for metaverse real estate investing, don’t forget about all the accompanying expenses. Besides the parcel’s price, you are likely to pay processing fees, which can amount to 5% of the land price, in addition to gas fees for Ethereum-based projects. Also, some metaverse platforms require you to trade in their native cryptocurrency. If you don’t have those, be prepared to exchange one currency for another with all the losses that this transaction entails.