What is robotic process automation in finance and banking?

RPA in finance can be defined as the use of robotic applications to augment (or replace) human efforts in the financial sector. RPA helps banks and accounting departments automate repetitive manual processes, allowing the employees to focus on more critical tasks and the firm to gain a competitive advantage.

A basic rule-driven robotic process automation is limited in what it can do. It simply follows the rules to automate tasks with no variation. For example, it can log in to an account, move some files, and log out.

To further enhance RPA, banks implement intelligent automation by adding artificial intelligence technologies, such as machine learning and natural language processing capabilities. This enables RPA software to handle complex processes, understand human language, recognize emotions, and adapt to real-time data.

In this article, we will use the RPA term to imply both regular and intelligent process automation.

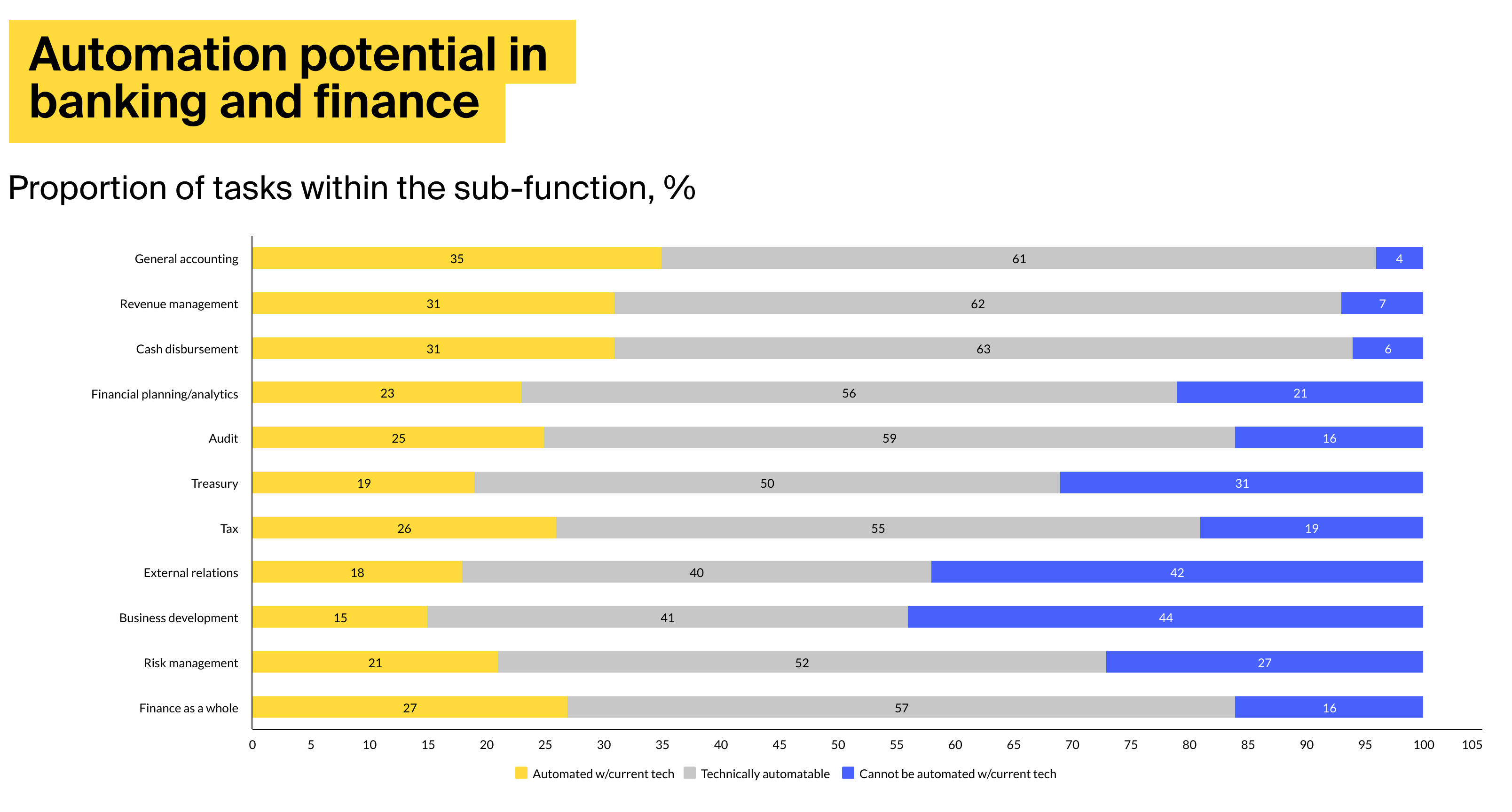

According to McKinsey, general accounting operations have the biggest potential for automation in finance. Business development functions can only be automated up to 56%.

Benefits of RPA in banking and finance

Robotic process automation is being used in different industries, such as healthcare, manufacturing, and insurance. The global RPA market was valued at $1.57 billion in 2020 and is expected to rise at a CAGR of 32.8% from 2021 to 2028. According to Gartner, 80% of leaders in the financial sector are already using some form of RPA for various purposes. Here are some of the most prominent benefits of financial process automation:

-

Allows you to scale operations seamlessly when needed. Robots can work longer hours and don’t need to take breaks. They can manage increasing request volumes during peak hours.

-

Saves time. When a robotic application is set up, it can reduce the time needed to perform specific tasks up to 90%.

-

Cuts down expenses. Deloitte estimates a 30% cost reduction as a result of RPA deployment. Accenture gives a more optimistic forecast and suggests an 80% cost decrease with robotics in finance for certain tasks.

-

Minimizes IT department interference. Employees can be trained to manage their own robotic assistants.

-

Ensures there are no extra infrastructure costs. Implementing RPA in finance and banking doesn’t require significant changes to the infrastructure. It is a layer that sits on top of the existing banking applications.

-

Increases human employee efficiency. Studies show that robots can work up to five times faster than humans on specific tasks. As a result, people do not need to waste time and energy on routine duties and can concentrate on something more fulfilling, increasing the overall employee well-being and job satisfaction.

-

Reduces human error. Financial RPA has a systematic way of handling its allocated tasks. It will increase output quality by eliminating errors that regular employees may make due to human nature, such as not paying close attention to the task at hand.

RPA use cases in banking and finance

1. RPA for report generation

Financial RPA can automate a large array of reporting tasks, including monthly closing, reconciliations, and management reports.

According to compliance rules, banks and financial institutions need to prepare reports detailing their performance and challenges and present them to the board of directors. These documents are composed of a vast amount of data, making it a tedious and error-prone task for humans. However, robotics in finance and banking can efficiently gather data from different sources, put it in an understandable format, and generate error-free reports.

Since Societe General Bank Brazil incorporated RPA for report generation into their processes, they automated a workflow that previously demanded six hours of employees’ working days.

In addition to helping employees generate reports, RPA in banking can also assist compliance officers in processing suspicious activity reports (SAR). Instead of reading long documents manually, officers rely on software with natural language processing capabilities. Such a system can extract the necessary information and fill it into the SAR form.

2. RPA for accounts payable

When done manually, handling accounts payable is time-consuming as employees need to digitize vendor invoices, validate all the fields, and only then process the payment. RPA in accounting enhanced with optical character recognition (OCR) can take over this task. OCR can extract invoice information and pass it to robots for validation and payment processing. In case of errors, the system will notify bank employees.

Our internal expert shared the following example from his portfolio. A baby stroller and car seat company wanted to automate its accounts payable validation process. The company has branches at various locations, and each one sends its financial documents in its own unique format, which differs from other departments. It is tedious to process all this manually and validate if the provided information is consistent with the bank’s statements.

Automating this verification function brought around $300,000 in annual savings.

3. RPA for mortgage processing

This is one of the most prominent RPA use cases in banking & finance. According to The Mortgage Reports, closing a mortgage loan can take banks up to 60 days. Loan officers need to go through many steps, including employment verification, credit check, and other types of inspections. Furthermore, a small error made by the employee or the applicant can significantly slow down the case. Robotic process automation in finance can cut loan-processing time by 80%, which will be a massive relief for both banks and clients.

Radius Financial Group relied on RPA in banking to accelerate mortgage processing. Before RPA, loan processors would feel overwhelmed handling 30 loans in their pipeline, but now with their robotic assistants, they feel comfortable managing up to 50 loans without feeling stressed. This configuration allowed Radius to cut loan processing costs by 70%.

Intelligent robotic automation allowed Radius to thrive even in the COVID era. The firm registered 30% more loan production revenue than the rest of the industry compared to the Mortgage Bankers Association average. The company also had about 50% more net income than average in the banking sector.

4. RPA in know your customer (KYC)

KYC is a time-consuming process that banks need to perform for every customer. It can eat up to 1000 full-time equivalent (FTE) hours and $384 million per year to perform this process in a compliant manner. Alert investigation is also time-consuming, while up to 85% of daily alerts are false positives, and around 25% need to be reviewed by level-two senior analysts. With all the efforts, banks are losing €50 million per year on KYC compliance sanctions.

Incorporating robotic process automation in finance into the KYC process will minimize errors, which would otherwise require unpleasant interactions with customers to resolve the problems. Therefore, RPA will accelerate customer onboarding and enhance customer experience.

5. RPA in fraud detection

In 2019, anti-money laundering compliance costs totaled $31.5 billion for financial institutions in both the US and Canada. According to studies, highly skilled analysts who are supposed to uncover such crimes are wasting around 75% of their time collecting data and another 15% entering it into the system. Both tasks can be automated allowing anti-fraud professionals to focus on their main job.

Robotic process automation in finance: implementation tips

Our internal RPA expert, Dzmitry Kliuchnik, recommends following these steps to get started with automation initiatives:

-

Choose your robotic process automation platform carefully. There are four reliable and tested options: UiPath, Workfusion, Blue Prism, Automation Anywhere While searching for a vendor, consider the type of automation you want to implement. Is it a basic level of automation with no machine learning? Or is it a more advanced RPA solution with computer vision and ML capabilities, such as an automated system for payment validation to prevent money laundering?

-

Find a vendor who will help you incorporate the selected RPA in finance solution into your system. When looking for an intelligent process automation services company, pay attention to their experience in your industry and the preferred technology stack, and their ability to look beyond RPA to AI and data science (if needed).

-

Roll up your sleeves:

-

Keep in mind that the legacy systems your organization is most likely using at the moment are challenging to automate. According to Reuters, 43% of the US banks use COBOL-based systems. COBOL is a programming language from the 1950s, and such systems are not compatible with today’s innovative technology.

-

Automated solutions should be failsafe and available 24/7. Make sure you have backup servers and are ready to switch automation architectures in real time.

-

Be patient. Automation is a time-consuming process. It takes around three months to automate simple processes from scratch, such as retrieving financial information from a PDF file and entering it into the corresponding database fields. And it can take up to a year to automate complex processes.

-

Ensure that the end-users of automated processes can still get work done without requiring long training sessions.

-

Foresee and implement different scenarios of the selected processes. Automating only the most common cases will not suffice in the long term as your employees will have to interfere.

-

-

Remember that automation is a gradual process. With an RPA in finance and banking solution in place, human employees will still need to monitor the results and interfere if the process encounters a case it has not seen before. It is normal that you will not be able to automate your process flow entirely at once. It is a continuous process. The usual practice is to start with implementing parts of the selected processes and letting employees take over the cases where automation is not applied yet.

As your business expands, your financial RPA solution may not suffice anymore, and you will need to look for more intelligent solutions. Dzmitry gave an example from his experience: A bank with many clients (mainly small farms) used a simple RPA solution to process balance sheets and other financial documents. While the clients’ business settings were similar, the paperwork was uniform. But when the bank’s client base started to expand and include other types of businesses, their RPA solution could not keep up. It couldn’t learn on the spot and process other formats of account payables and receivables coming from the new clients.

The bank wanted to build a more comprehensive financial RPA system with machine learning abilities that could expand and learn how to handle new document formats and extract the relevant fields. After deploying the new robotic process automation solution, bank employees experienced a four-fold increase in productivity.

A final note

Robotic process automation in banking and finance is a continuous process. You can’t automate everything at once, and it is a good practice to select your starting point carefully. Here is what Dennis Gannon, Vice President of Advisory Services at Gartner, recommends beginning with:

“A good candidate for RPA is a task that is a bottleneck in a larger process that may take hours of manual work.”

In other words, start small with concrete sub-processes/tasks. Identify them on your process map, prioritize based on the benefits their automation can yield, and develop and document a set of possible case scenarios of the selected workflow. After the most tedious tasks are automated, you can move at your own pace towards full automation.